C Corporation Vs S Corporation – The Differences and Advantages of Each

C Corporations Vs S Corporations: What’s the Difference and Benefit of Each?

Selecting the ideal entity for your business can be critical to its success. Which structure you pick will have an impact on both its finances and taxes paid. Make sure you make the right choice!

There are various business entities, such as partnerships, sole proprietorships and LLCs. You may also form a trust or estate but these structures lack the flexibility of a C Corporation.

In the United States, C Corporations are the most common type of corporation. They offer their owners numerous advantages such as liability protection, stock issuance and public offering options.

Liability Protection: Forming a C Corporation has the major advantage of limiting personal liability for directors, shareholders and employees. This is because all legal obligations of the company cannot become personal debt obligations for any of its members or directors. Furthermore, this helps prevent businesses from going bankrupt and gives them greater credibility with customers and partners alike.

Shareholders: Incorporating a business makes it easier for people to invest in it since you can issue shares of stock (also known as ownership shares). Investors tend to be more willing to give money this way, and by issuing these shares you can quickly raise capital through increased operations.

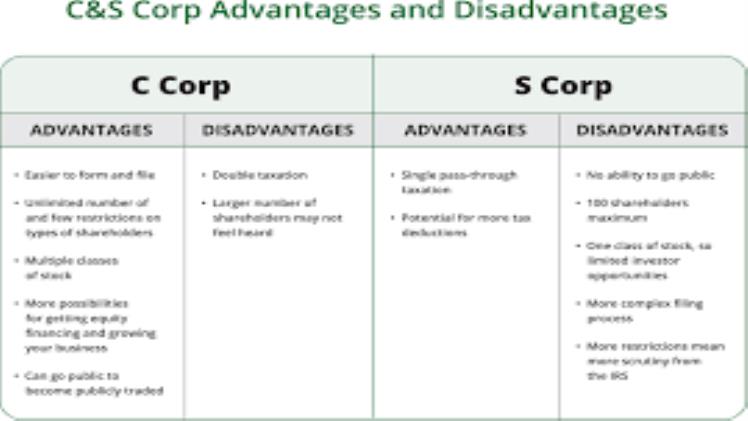

Low Tax Rates: One major advantage of incorporating a business is that it can accumulate capital at lower tax rates than an S corporation, limited liability company (LLC), partnership, or proprietorship. This is because corporations avoid paying personal income tax on their earnings and instead use those profits for paying off accounts receivable, inventory, and fixed assets.

Establishing a Business: The initial step in incorporating your business is selecting a name and filing articles of incorporation with your state. Each state has its own regulations and filing procedures for registering your company with them.

The next step in starting your business venture is selecting a board of directors and holding regular shareholder meetings. Attending these gatherings is essential for maintaining compliance while making sure everything runs smoothly within the business.

Maintain accurate records of meetings and any related activities at all times in order to prepare for any potential litigation, and ensure your business continues operating within the law.

Double Taxation: Incorporating a business can have serious tax repercussions when it earns income and distributes it to its shareholders as dividends. This is because corporations pay taxes at both the corporate level, while each shareholder must pay taxes on their dividends at an individual level.

Other Disadvantages: Incorporating a business can be costly due to the numerous fees involved with the process, which could prove particularly burdensome for newly formed businesses.