Fintech and the Growth of Mobile Payment Solutions and Digital Banking

Fintech is an emerging industry that utilizes cutting-edge technology to transform how financial transactions are carried out, making certain types of tools and services more accessible and budget friendly.

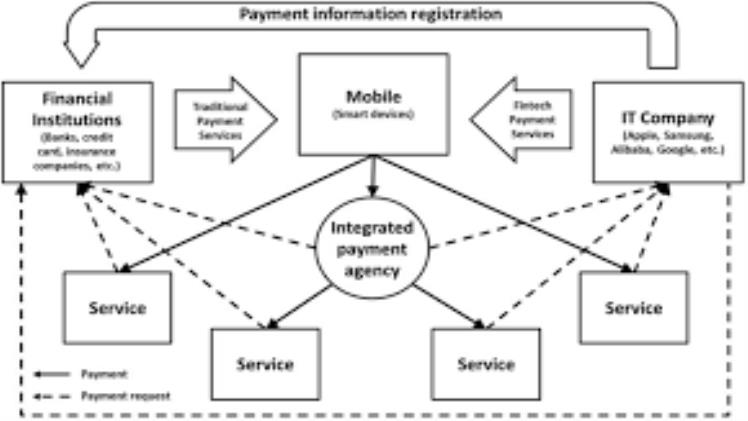

The growth of mobile payment solutions and digital banking is one of the major trends in the financial industry right now. This makes the process of paying for items easier, faster, allowing people to spend more money on what they desire.

Banks can benefit greatly from such technologies, as they help them stay competitive and meet the needs of their customers. Furthermore, these advancements allow banks to reduce costs and streamline operations.

Fintech can be employed in three primary ways by banks: offering digital services, cutting fees and improving customer experiences.

1. Utilizing fintech for banking:

Banks can offer their clients a range of new services to stay on top of their finances and save time, such as real-time spending notifications, 24/7 in-app support, free payments while traveling, regular spending reports, and spending projections. These innovations help banks stay ahead of the competition by helping customers stay organized financially.

2. Utilizing fintech for bill payment:

Bill payment has never been simpler thanks to the growth of digital banking. These services enable customers to receive secure message alerts whenever there is any change in their account balance, helping them pay all bills on time.

3. Leveraging fintech for investments:

Financial institutions are increasingly considering entering the fintech space, as it offers them a new revenue stream and increases customer satisfaction. Many of these companies have collaborated with fintech firms and created products that benefit both parties.

4. Utilizing fintech for lending:

Cryptocurrencies are another trend that benefits both banks and Fintech firms alike, offering more accessible financial solutions than traditional loans that often carry high interest rates. These kinds of financial products provide quicker access to capital than ever before.

5. Utilizing Fintech for Lending:

Fintech lending can bring several advantages to both banks and Fintech firms, such as lower interest rates on loans, more liquidity in the markets, and reduced risk.

6. Utilizing fintech for crowdfunding:

Crowdfunding has seen a meteoric rise in popularity as an alternative means of funding projects. These kinds of crowdfunding platforms provide small businesses and startups with an easy way to raise capital.

7. Utilizing fintech for investment:

These platforms are becoming more and more popular, providing investors with a convenient way to invest in start-ups without needing to contact an agent or broker face-to-face.

8. Leveraging fintech for insurance:

As well as making the financial world more accessible, Fintech also has its drawbacks. Some people worry that an increased reliance on Fintech could lead to greater bias in the market place; companies may have financial incentives to push certain types of product at the expense of others who need assistance most. 8. Implementing fintech in healthcare:The benefits of Fintech have far-reaching – from making healthcare more efficient and accessible to improving lives at-risk